Have M-rated video games grown their market share?|Ten Years Ago This Month

Does the market still rely on violent video games as it did before publishers started betting on less, bigger, bloodier titles?

The video game industry evolves really quickly, and everyone involved has a tendency to always look to the future without giving much thought to the past. That being said, even a market that is well-established today can learn from the past. GamesIndustry.biz publishes a monthly feature that highlights events in the video gaming industry from exactly a year ago in an effort to refresh our collective memory and perhaps offer some perspective on the history of our industry.

If it seems like we just published our monthly retrospective column the other day, it was.

The Xbox One reveal incident occurred in May of 2013, consuming the entire column and leaving little room for other subjects like the comparatively timeless one we’re going to discuss today: violence.

Years ago, I wrote an essay about the video gaming industry’s growing reliance on violent games.

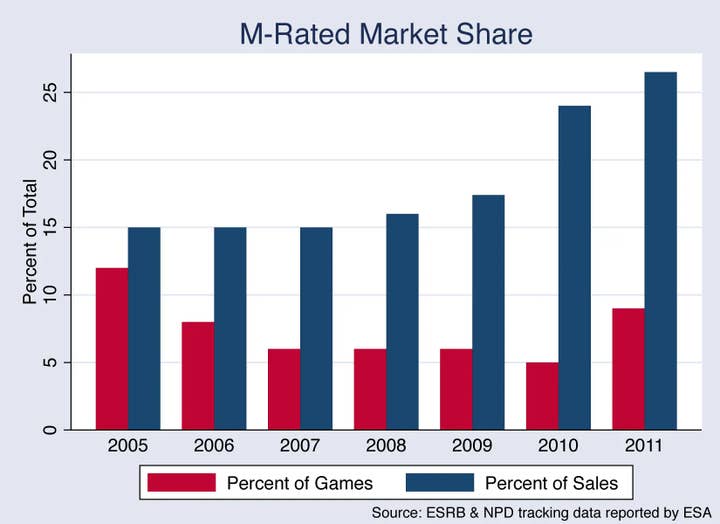

The most important piece of evidence was the fact that, despite a decline in the percentage of M-rated games released year, their share of market revenues had been significantly increasing. Only around 9% of video games in 2011 were rated M, but they collectively accounted for almost 27% of American revenue.

After the 2011 statistics were released, the Entertainment Software Association ceased reporting on each score’s market share, perhaps because it was unclear just how much higher the M-rated market share may increase. Many political leaders continued to use the market as a convenient scapegoat, and even a Supreme Court ruling affirming video games’ rights to completely unrestricted free speech would not end this practise.

In putting together this month’s 10 Years Ago column, I came across that editorial and became interested in how those figures might seem now.

M-rated titles like Call of Duty and Grand Theft Auto have grown more popular recently than they did a few years ago, while the best installments of Mortal Kombat, Assassin’s Creed, Resident Evil, and God of War have all been released recently.

Thanks in part to Nintendo’s relative strength currently compared to its relative weakness in 2011, the other end of the scoring spectrum is also substantially more potent today.

By 2011, the Wii craze had all but collapsed, and it wasn’t until the release of Mario Kart 7 and Super Mario 3D Land for the 3DS that the system started to recover from its disastrous launch.

Contrast that with recent years, when the Switch has thrived along with blockbusters like Fortnite (rated T) and Minecraft (E10+).

If you include in how much the pandemic expanded the market by bringing in both old and new customers, I might have seen that M-rated market share increasing in either scenario.

With a few caveats, the statisticians at Circana (formerly NPD, which put together the initial market share estimates for the ESA) were willing to pique my curiosity. Since Nintendo does not disclose its digital sales to the industry and the absence of Switch first-party games would significantly change the results, they gave me the M-rating market share for physical sales for the preceding five years.

In addition, they kept in mind that the formula’s exclusion of downloadable content, microtransactions, and membership fees suggests that these recent numbers don’t represent a console or PC market analysis as thorough as the ones from many years ago that we’re comparing them to.

However, owing to Circana, we now have more information than we did before.

And if you were wondering if the market share of M-rated films has actually increased or decreased since 2011, the answer is “both.”

- 2018 – 35.1%

- 2019 – 30.1%

- 2020 – 26.2%

- 2021 – 20.6%

- 2022 – 22.1%

That 2018 number is somewhat frightening, right? Red Dead Redemption 2 and Call of Duty: Black Ops 4 were the top two best-selling video games that year, both of which were M-rated, and there was only one Switch title in the top 10 (Super Smash Bros Ultimate, at No. 5).

As a larger audience of people either rediscovered consoles or gave them a go in the first place, I believe the Switch and the pandemic, together, drove the drops since 2020, though it appears both of those influences may be fading.

I was concerned about the medium’s self-marginalization at the time, but today the world of video games seems much larger.

And although the lack of Switch first-party sales in the digital data would probably change those percentages towards a bigger portion of M-rated games, so would the fact that the more diverse Switch customer base has actually not embraced digital distribution as much as others.

In contrast to the developers of games like Far Cry, Nintendo revealed that over 48% of software application revenues in 2015 came from the sales of physical video games.

In 2015, digital sales made over 85% of Ubisoft’s business. The percentage for EA is 90%. 95% of Take-Two’s profits came from the digital market. It was 96% for Activision Blizzard. Some of those figures are changed by highly digital companies like Blizzard, King, and Zynga, but the balance of digital and physical components in Nintendo video games stands out from the competition.

Even if the overall M-rated market share on consoles and PC surpasses the 2018 high of 35.1%, I would find it difficult to invoke the same problem that I did a few years ago. The overall M-rated market share on consoles and PC may be very ugly when you consider the digital data.

I was concerned at the time that the medium would become marginalised if it relied too heavily on the senseless violence that the AAA industry so frequently used as a sales hook.

These days, the video game industry is so much more expansive outside of AAA. Not only do we have an apparently limitless selection of independent and mobile video games offering various visions of what video games can be, but many of them also succeed enough to have their alternative approaches to whatever then feed back into AAA and influence what we see from there, in addition to benefiting from traditional attention and the AAA world.

Over the previous years, the market has truly flourished and diversified, creating megahits across a variety of platforms, audiences, and lucrative business models. The Last of the United States is not Zelda: Tears of the Kingdom, Candy Crush, League of Legends, Genshin Impact, or even Candy Crush.

The M-rated end of the AAA console and PC business is merely another name in the crowd now rather than the market’s face. It ultimately results in a victory for everyone.